Empowering Real Estate Investors, Developers, and Funds to Grow with Confidence.

We work alongside investors, developers, and funds as they start, grow, and scale their portfolio. Our comprehensive approach combines sophisticated financial modeling, rigorous due diligence, and expert project guidance to optimize returns and minimize risk.

RCA AnalystEdge® Consulting Services

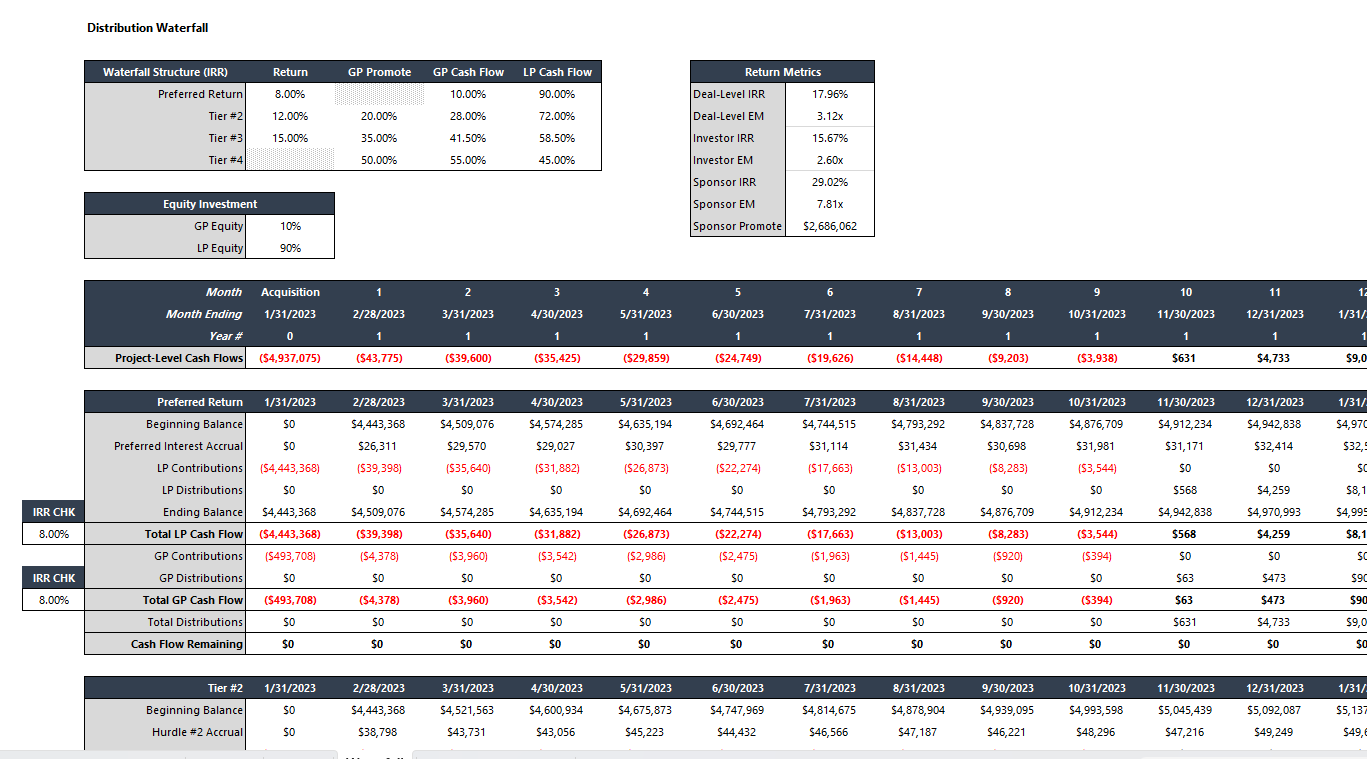

Gain the power of an institutional real estate financial analyst team at your disposal. AnalystEdge® provides on-demand access to our financial analysts, delivering sophisticated modeling, detailed analytics, and comprehensive deal support whenever you need it. From complex waterfall calculations to detailed scenario analysis, our team becomes an extension of yours, providing the analytical firepower needed to evaluate opportunities, optimize performance, and drive better investment decisions.

Real Estate Financial Modeling

Portfolio & Asset Management Solutions

Fund Formation Strategy, Management & Compliance

Syndications & Private Capital Structuring

Pitch Decks & Investment Materials

Waterfall Compliance & Calculations

Project Feasibility & Risk Assessment

Deal Evaluation & Due Diligence

Scenario & Sensitivity Analysis

Asset Valuation & Cash Flow Analysis

Investment Committee Materials & Strategy

Joint Venture & Partnership Structuring

Debt & Capital Stack Analysis

Acquisition & Disposition Support

Investor Relations Guidance

1031 Exchange Services

Our integrated platform provides solutions across the entire investment lifecycle - from sophisticated financial modeling and detailed due diligence, to fund formation and portfolio management. By combining advanced analytical capabilities with deep operational expertise, we help clients execute complex transactions, optimize asset performance, structure strategic partnerships, and build institutional quality investment programs. Whether you're evaluating a single asset or managing a diverse portfolio, our comprehensive services provide the analytical depth and strategic guidance needed to drive superior risk-adjusted returns.

Setup a quick call with our team →

We focus on our clients' portfolio needs through a broad spectrum of services including acquisitions, dispositions, due diligence, financial modeling, capital structuring, syndication support, fund management, and other real estate consulting services. We’ve generated successful results throughout every major asset class in real estate and pride ourselves on exceeding client expectations with every deal.

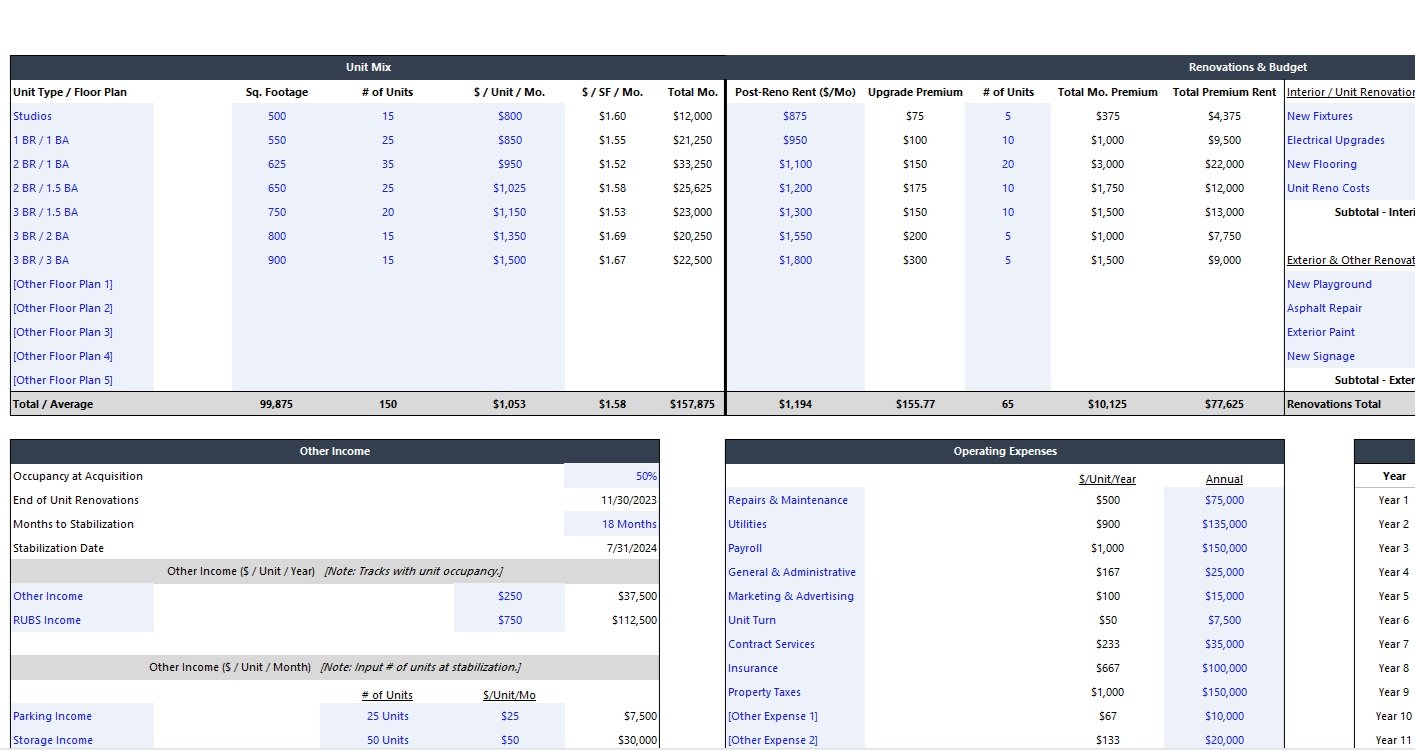

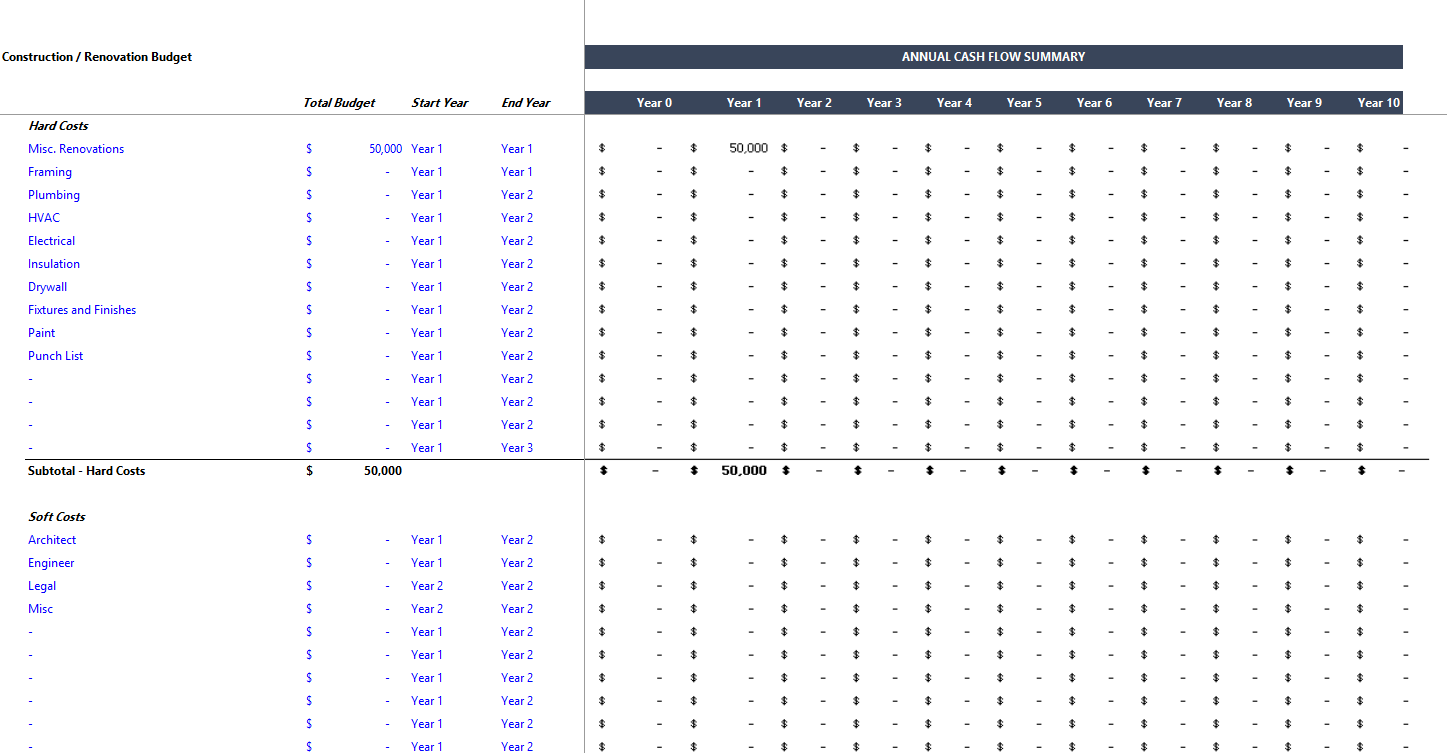

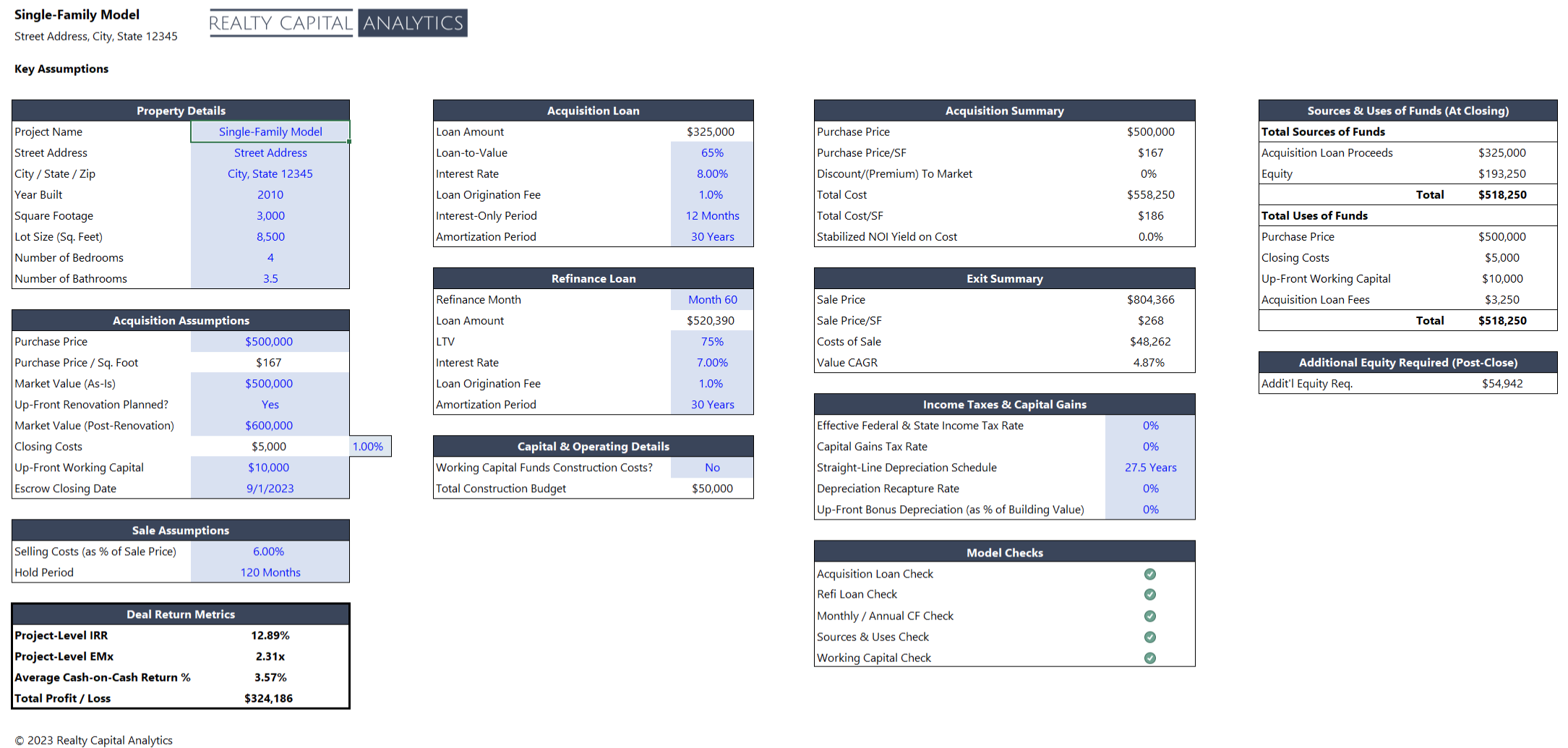

Institutional quality real estate Excel® models for acquisitions, developments, syndications, and private equity funds.

We offer custom Excel®-based solutions in the following areas:

Multifamily (Market Rate, Affordable & LIHTC)

Industrial

Office

Retail

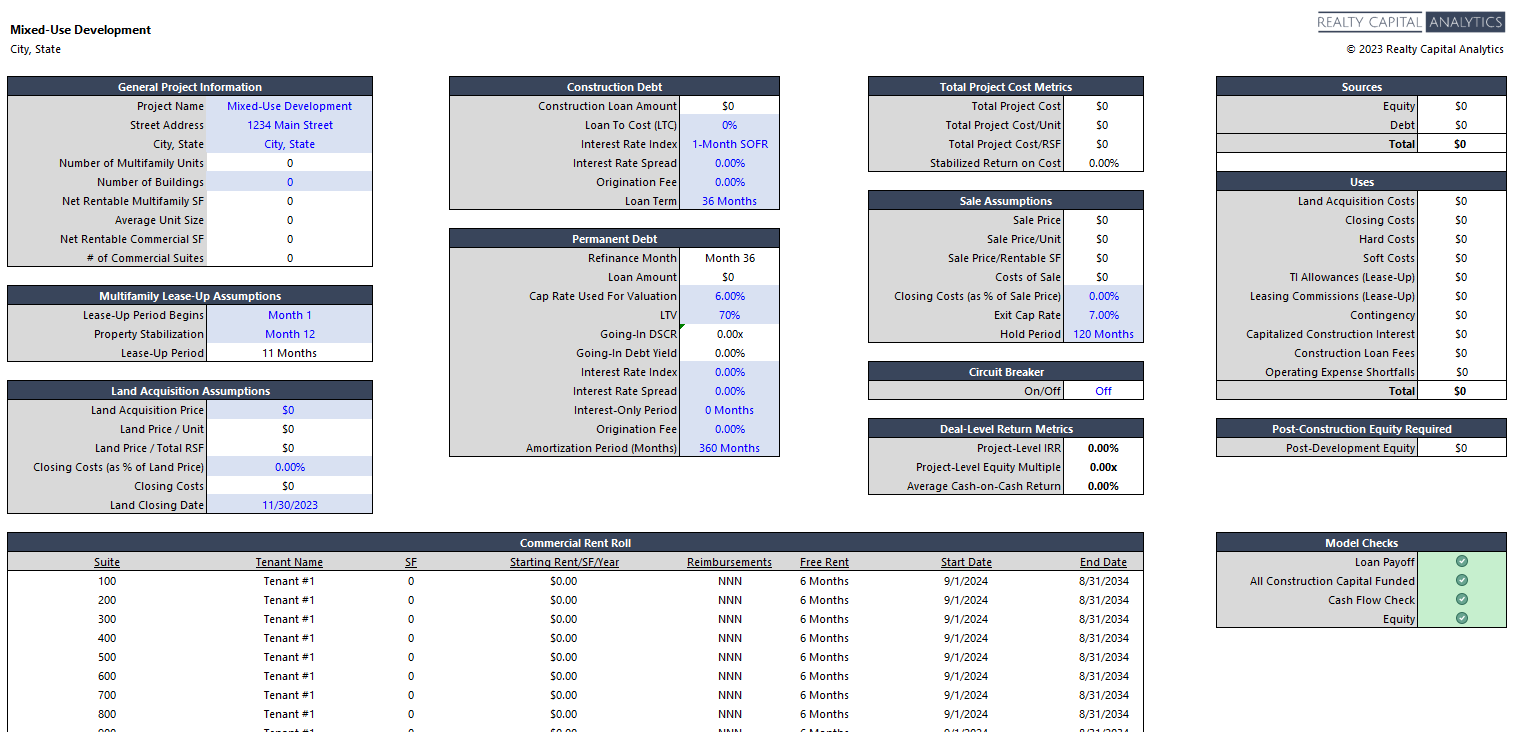

Mixed-Use

Land Development

Hotel/Hospitality

Waterfalls & Partnership Structuring

Real Estate Debt Fund Modeling

Real Estate Private Equity (REPE) Fund Modeling >

Portfolio & Asset Management Models >

Townhomes

Condominiums

Ground Leases

Self-Storage

Senior Living

Marinas

Golf Courses

Mobile Home & RV Parks

Data Centers

“Back of the Envelope” Models >

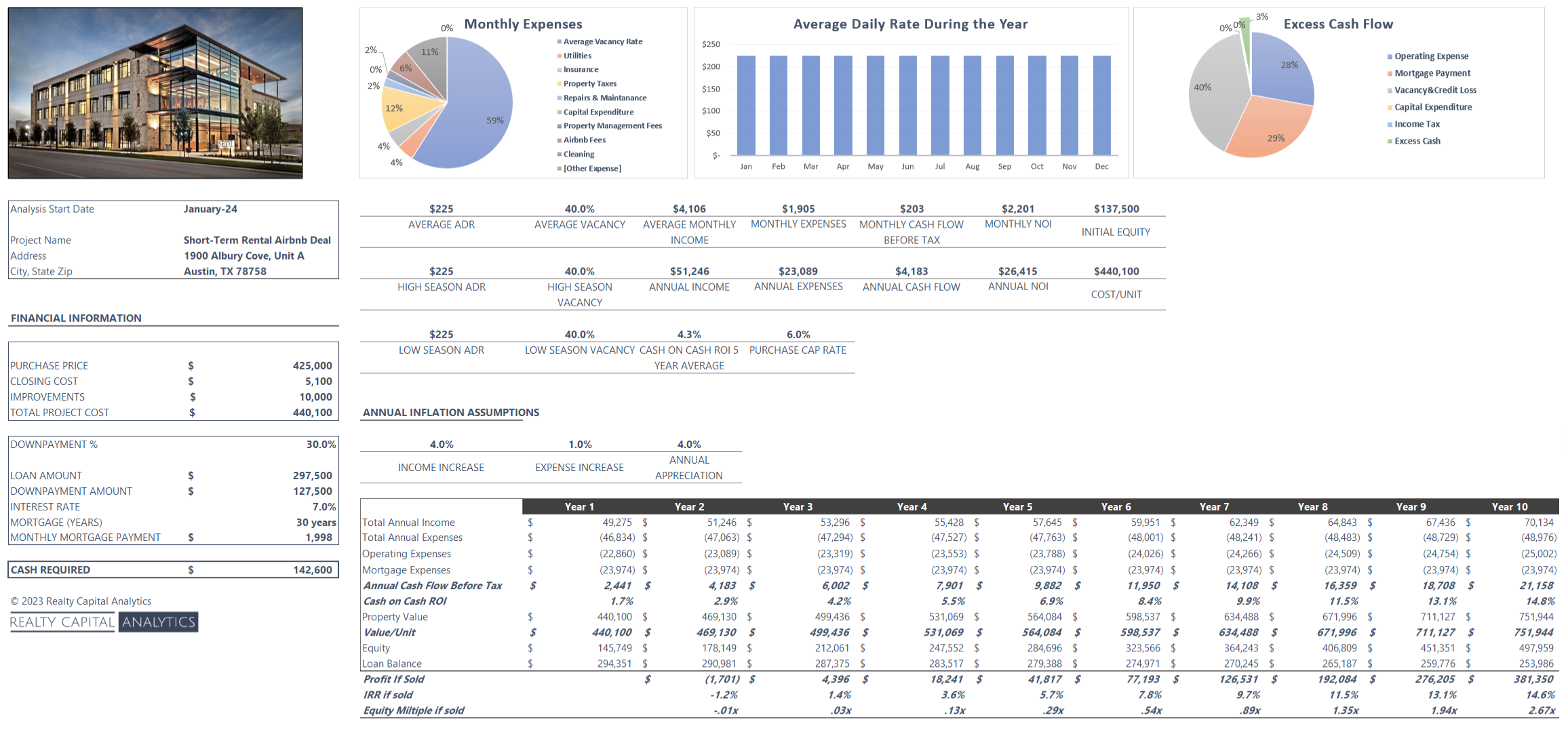

Single-Family Fix/Flip & Airbnb Models >

Why Clients Love Our Excel® Models

“RCA’s models we’re a game changer, allowing us to be more efficient, raise more capital, and close more deals.”

✓ Fully Transparent Excel® Formulas

✓ Print-Ready Dynamic Output Pages

✓ Key Assumptions on Single Input Tab

✓ Monthly & Annual Cash Flow Details

✓ T-12 Cash Flow Analysis for Acquisitions

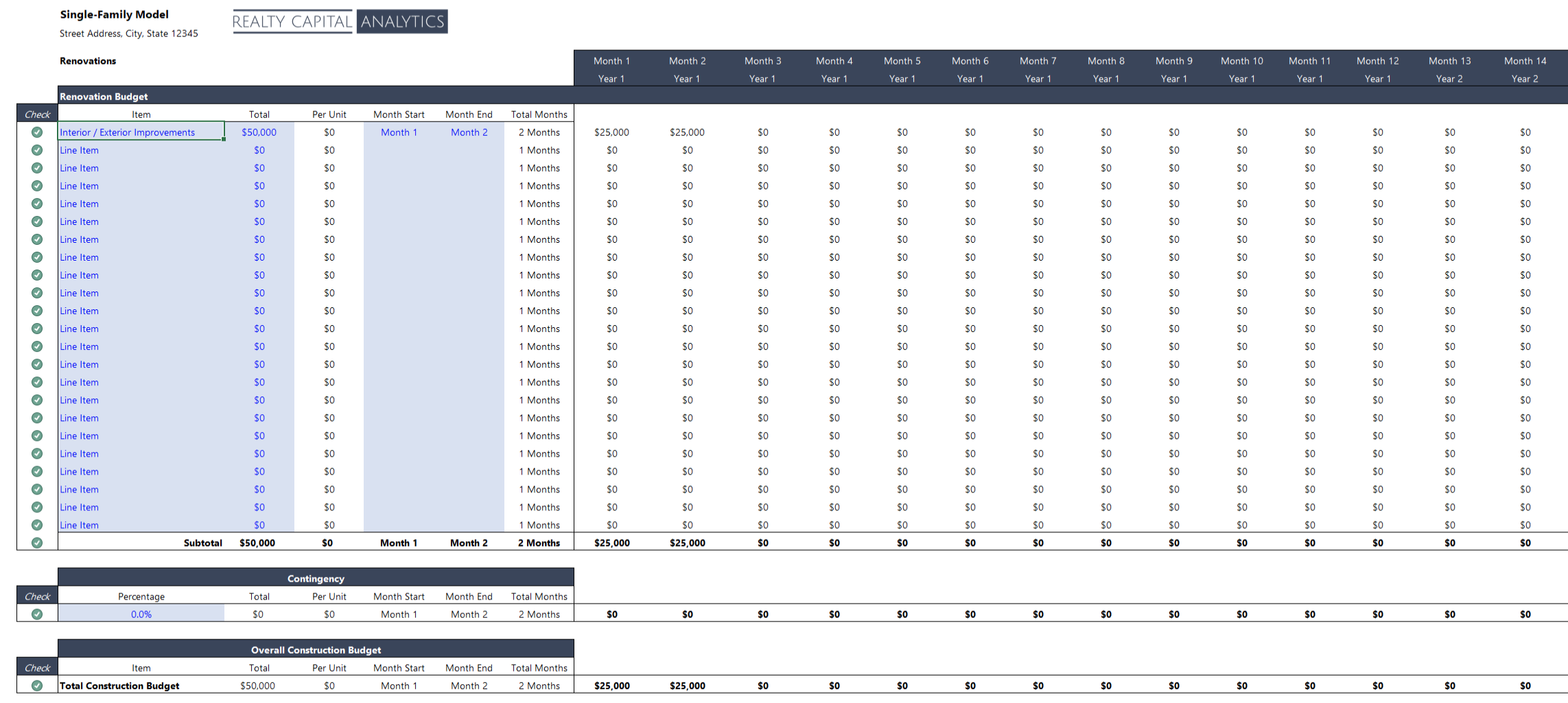

✓ Renovation & Construction Budgets

✓ Detailed Operating, Timing & Exit Assumptions

✓ Acquisition, Construction & Refi Debt Capabilities

✓ Gross/Net Returns Summary (IRR, EMx, Profit, Etc.)

✓ Multi-Tier JV Waterfall with Pref, Hurdles & Promotes

Whether using Excel®, Argus®, or other real estate modeling software, we can thoroughly evaluate cash flows and returns at the property, portfolio, investor, or fund level across all real estate asset classes. We also handle specialized areas of advanced real estate finance such as complex debt models, buy/lease decision models, waterfall models, and more.

About Realty Capital Analytics

We aim to be trusted advisors in navigating the complexities of real estate investing, asset management, capital markets, and fundraising, dedicated to tailoring our services to our clients’ dynamic needs.

“Relentlessly committed to client success one deal, and one dollar at a time.”