Real Estate Financial Models: Advanced AI-Powered Excel® Models from RCA

Institutional-Quality AI-Powered Real Estate Financial Models

Acquisition Models • Development Models • Portfolio Models • Fund Models • Waterfall Models • Fundraising Guidance

Now with built-in live market data using RCA Market Sonar® to validate assumptions quicker and easier than ever.

Real Estate Financial Models from Realty Capital Analytics

Real estate financial modeling is a sophisticated process that involves the creation of intricate financial models to assess the viability and profitability of real estate investments. This requires a meticulous understanding and analysis of various financial components, including cash flows, costs, capital expenditures, debt structures, potential returns, and waterfall distribution mechanisms. The primary objective of real estate financial modeling is to provide investors and stakeholders with a comprehensive understanding of the financial implications associated with different investment opportunities, enabling you and them to make informed decisions. By examining the intricacies of real estate financial modeling, this article explores its advanced techniques and diverse applications, providing you with a thorough understanding of the concepts and methodologies employed in this field. Armed with this knowledge, you will be better equipped to navigate the complexities of the real estate private equity industry and make sound investment decisions. Furthermore, we will introduce you to the cutting-edge real estate financial models developed by us at Realty Capital Analytics, which incorporate the latest industry insights and best practices to help investors and professionals stay ahead of the curve in this competitive landscape. Join thousands of investors and secure your competitive edge with Realty Capital Analytics today.

Types of Real Estate Financial Models

There are several types of real estate financial models, each with a different focus depending on the type of investment. Some of the most common models are:

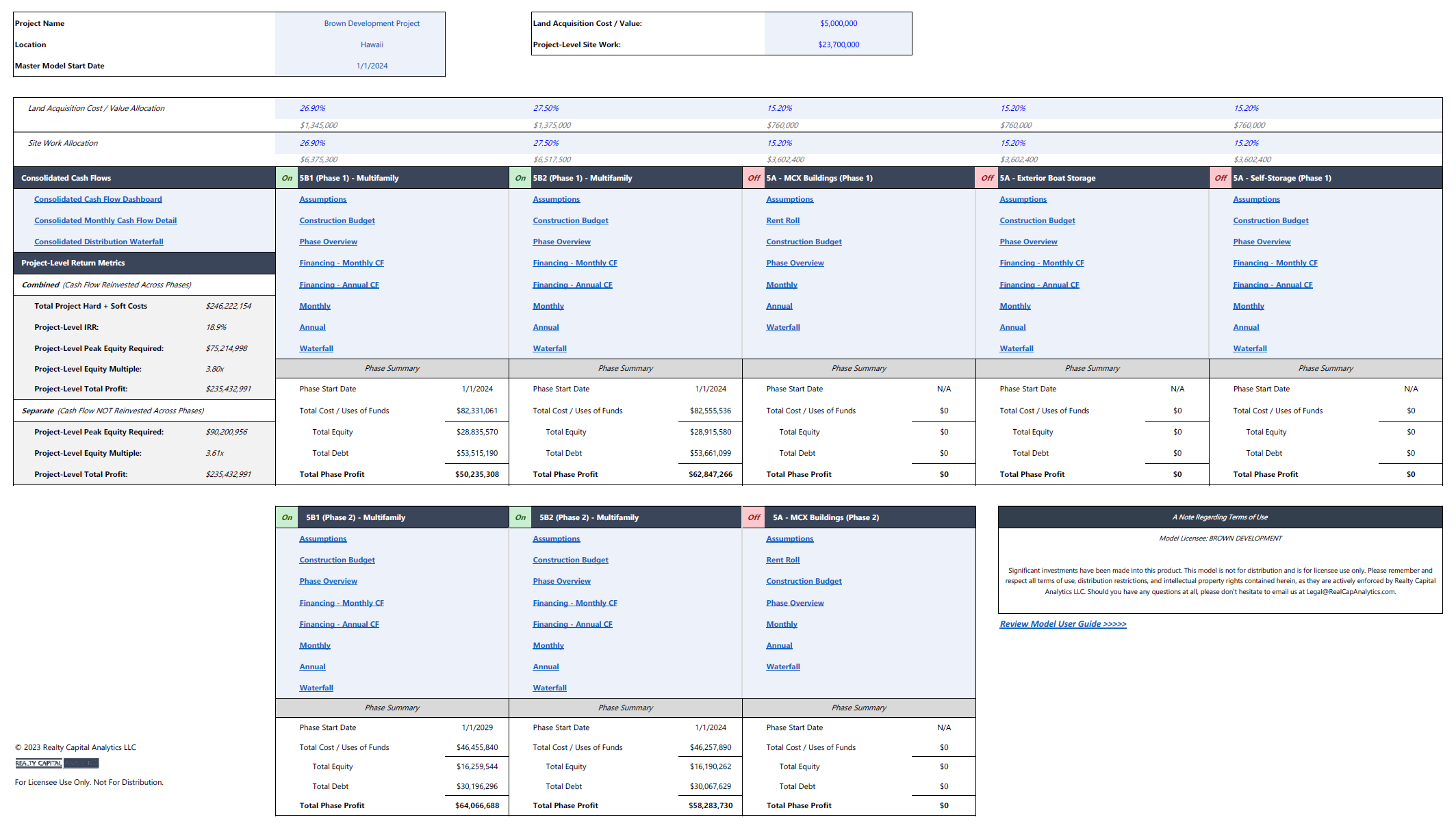

Real Estate Development Models

Development models are integral for assessing the financial viability of real estate development projects, encompassing the intricate balance of costs associated with land acquisition, construction, and various development expenses against the anticipated revenue from the project's completion. These models are particularly nuanced in their treatment of debt financing, where the structure of loans can significantly influence the project's cash flow, both during the construction phase and post-completion. They meticulously account for the timing of equity injections and debt drawdowns, ensuring a comprehensive analysis of the project's financial health throughout its lifecycle. Moreover, development models by Realty Capital Analytics incorporate sensitivity analyses to evaluate how changes in key variables such as construction costs, interest rates, and leasing rates impact the project's financial outcomes, providing developers with a robust framework for risk assessment and decision-making.

Real Estate Acquisition Models

Acquisition models play a pivotal role in evaluating the financial prospects of purchasing existing properties. These models delve into the intricacies of the acquisition process, analyzing not just the initial purchase price and financing options but also the operational nuances that could affect the investment's performance, such as operating expenses, revenue projections, and potential capital improvement costs. By doing so, they offer a detailed forecast of the investment's return potential. Realty Capital Analytics enhances these models with advanced features that allow for the assessment of various financing structures and their impacts on investment returns, facilitating strategic decision-making for investors aiming to maximize their portfolios' value.

Value-Add Financial Models

Value-add models are specialized tools designed to assess the viability of investments in real estate requiring substantial improvements to unlock additional value. This category includes strategies such as renovations, repositioning, and rebranding, with the models taking into account not just the improvement costs but also the anticipated enhancements in revenue and overall property valuation. A key strength of value-add models from Realty Capital Analytics is their ability to simulate the financial impact of different value-add strategies, incorporating market trends and property-specific dynamics to forecast the expected increase in value and optimize the return on investment. These models serve as a critical guide for investors looking to transform underperforming assets into lucrative investments.

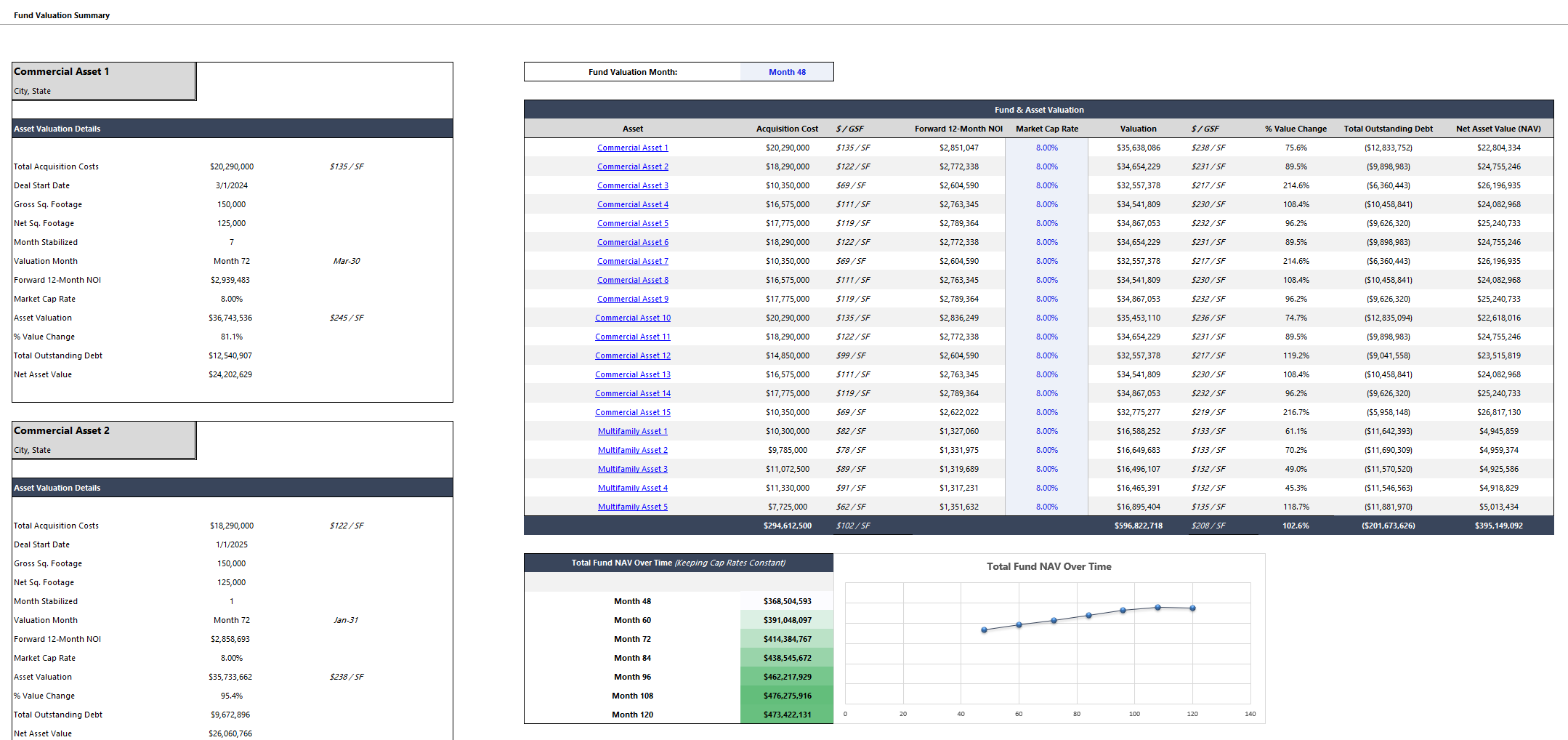

Real Estate Fund Models

Real estate fund models are sophisticated tools designed to evaluate and manage the complexities of real estate investment funds. These models are crucial for fund managers, investors, and analysts in assessing the overall performance of a diversified real estate portfolio. Realty Capital Analytics' fund models incorporate advanced features that allow for the seamless integration of multiple property types, investment strategies, and capital structures within a single, comprehensive framework. These models meticulously track fund-level metrics such as internal rate of return (IRR), equity multiples, and distribution waterfall structures, providing a holistic view of fund performance. Furthermore, they offer the flexibility to analyze various scenarios, including different acquisition and disposition strategies, financing options, and market conditions, enabling fund managers to optimize their investment decisions and communicate effectively with investors. By incorporating robust risk management features and compliance tracking, these models also ensure that fund operations align with regulatory requirements and investor mandates, fostering transparency and trust in fund management.

Real Estate Portfolio Models

Portfolio models serve as essential tools for investors and asset managers overseeing diverse real estate holdings. These comprehensive models are designed to aggregate and analyze the performance of multiple properties across various asset classes, locations, and investment strategies. Realty Capital Analytics' portfolio models excel in providing a consolidated view of an investor's entire real estate portfolio, offering insights into key performance indicators, risk exposure, and portfolio diversification. These models are particularly adept at handling complex scenarios, such as cross-collateralized debt structures, portfolio-wide cash management strategies, and the impact of macroeconomic factors on overall portfolio performance. By incorporating advanced analytics and data visualization techniques, these models enable investors to identify trends, optimize asset allocation, and make informed decisions about acquisitions, dispositions, and capital improvements across their portfolio. Moreover, the portfolio models facilitate stress testing and scenario analysis, allowing investors to assess the resilience of their portfolio under various market conditions and adjust their strategies accordingly, ensuring long-term portfolio stability and growth.

Property Operating Models

Property operating models are essential for the ongoing financial management of investment properties, offering a detailed analysis of revenue streams, operating expenses, financing costs, and cash flow projections. These models are designed to provide investors with a clear picture of the property's operational performance and its contribution to the overall investment portfolio. By offering a comprehensive view of the financial health of properties, these models empower investors with the insights needed to make informed decisions about property management, capital investments, and strategic exits.

Access Better Insights with our Institutional Quality Real Estate Financial Models - Explore Now >

Importance of Real Estate Financial Modeling

Real estate financial modeling is essential for investors to make informed decisions on investment opportunities. Financial models help investors to:

Estimate investment returns and potential profits, both at the deal level and the investor level (read more about waterfalls, fees, and promotes below).

Identify potential risks associated with investments.

Evaluate different investment scenarios and compare them.

Determine the feasibility of a real estate project.

Secure funding for real estate investments.

A Comprehensive Guide to Real Estate Syndication and Waterfall Structures

Key Return Metrics Every Investor Should Know Inside & Out

To understand real estate financial modeling, there are some basic concepts you need to understand around investment returns to measure the success of your project:

Cash Flow: the amount of money generated or consumed by a real estate investment.

Discount Rate: the rate of return required by an investor to justify an investment.

Net Present Value (NPV): the present value of expected future cash flows, discounted by the discount rate.

Internal Rate of Return (IRR): the rate of return at which the NPV of an investment equals zero.

Equity Multiple (EMx): the total cash distributions received from an investment, divided by the total equity invested.

Yield-on-Cost: the yield on cost is a property’s net operating income divided by its total acquisition cost.

Cash-on-Cash Return: the amount of cash flow relative to the amount of cash invested in a property.

Peak Capital: The maximum capital required during the life of an investment.

Explore Key Return Metrics Every Real Estate Investor Should Know When Underwriting a Deal

Key Components of a Real Estate Financial Model

Real estate financial models are powerful tools that helps investors and developers evaluate the potential financial performance of a real estate investment. It includes several key components that work together to calculate the expected returns and risks associated with the asset.

General Assumptions

Assumptions form the bedrock of any real estate financial model. They encompass a wide range of inputs, such as the property's acquisition or development costs, projected income, occupancy rates, and operating expenses. These assumptions should be grounded in reliable market data and align with industry benchmarks to ensure the model's accuracy and credibility.

Revenue Projections

Revenue projections forecast the income the property is expected to generate over a defined period, typically spanning several years. These projections take into account various sources of income, including rental income, fees, and other ancillary revenue streams. By carefully analyzing market trends, vacancy rates, and lease terms, investors can develop robust revenue projections that provide a clear picture of the property's earning potential.

Operating Expenses

Operating expenses encompass all the costs associated with operating and maintaining the property. These can include property management fees, utilities, maintenance and repairs, property taxes, and insurance premiums. Accurately estimating these expenses is crucial for determining the property's net operating income and overall profitability.

Capital Expenditures

Capital expenditures (CapEx) refer to investments in the property that go beyond routine maintenance. These expenditures are typically made to enhance the property's value, extend its useful life, or upgrade its components. Examples of CapEx include major renovations, system replacements, and structural improvements. Incorporating appropriate capital expenditures into the financial model helps investors plan for these more substantial cash outlays and assess their impact on the investment's long-term performance.

Debt Financing

Debt financing is a critical component of most real estate investments. It involves borrowing the necessary funds to acquire, develop, or improve a property. The financial model must account for the terms of the debt, including the loan amount, interest rate, origination fees, exit or yield maintenance fees, and repayment schedule. By accurately modeling the debt structure (including acquisition, refinance, mezzanine, and other supplementary debt), investors can evaluate the investment's leverage, cash flow, and overall return on equity.

The Waterfall

Waterfalls are a key feature of many real estate investment partnerships. They determine how cash flows and profits are allocated among the partners based on their agreed-upon terms. Real estate financial models should incorporate custom-built waterfalls that reflect the specific contribution and distribution arrangements of the investment.

There are several types of waterfall structures, each with its own set of priorities and hurdles. Some of the most common features and terms of a waterfall include:

Pari Passu: Pari passu is a Latin phrase meaning "on equal footing" or "proportionately”. In the context of a real estate investment, it refers to a distribution structure where all partners receive returns in proportion to their ownership percentage or capital contribution.

Preferred Return: In a real estate investment with a preferred return structure, investors are entitled to receive a predetermined rate of return on their invested capital before the sponsor or developer receives any profit or promoted interest. This preferred return is usually in the range of 6% or 10% and may be referred to as a “pref” for shorthand.

Promotes: A promote, also known as a "promoted interest" or "carried interest," is a form of performance-based compensation earned by the sponsor or developer of a real estate investment. It represents a disproportionate share of profits awarded to the sponsor once certain performance benchmarks, called hurdles, have been met. In a typical promote structure, the sponsor will receive a larger share of the profits above and beyond their pro-rata ownership percentage after investors have received their preferred return and return of their initial capital. The promote is intended to reward the sponsor for their expertise, effort, and success in managing the investment.

Hurdles: Hurdles in real estate investments are predetermined performance benchmarks that must be met before the sponsor or developer is entitled to receive their promoted interest (or "promote"). These benchmarks are designed to align the interests of the sponsor with those of the investors by ensuring that the sponsor is only rewarded for superior investment performance. Common types of hurdles include IRR (Internal Rate of Return) hurdles, which require the investment to achieve a specified annualized rate of return, and equity multiple hurdles, which require the investment to return a certain multiple of the initial capital invested. Hurdles can be structured as a single threshold or as multiple tiers, with increasing promote percentages for the sponsor as higher hurdles are met. The specific terms of the hurdles are negotiated between the investment partners and are clearly defined in the investment's operating agreement or private placement memorandum.

It's important to note that the specific terms of promotes and hurdles are negotiated between the investment partners and can vary widely depending on the nature of the investment, the market conditions, and the bargaining power of each party. Clear and well-defined promotes and hurdles are essential for aligning the interests of all stakeholders and ensuring a fair and profitable investment outcome. Realty Capital Analytics offers financial models that feature custom-built waterfalls tailored to your specific investment terms. By accurately modeling the waterfall structure, investors can better understand their potential returns and the alignment of interests among the partners.

Access Better Insights with our Institutional Quality Real Estate Financial Models - Explore Now >

Best Practices for Real Estate Financial Modeling

To make the most of real estate financial modeling, it’s important to follow some best practices, including:

Accuracy and Sensitivity Analysis

It’s important to ensure that the assumptions used in the financial model are as accurate as possible and to perform a sensitivity analysis to assess the impact of changes in those assumptions on the model’s outputs.

Updating Assumptions Regularly

Real estate investments can be subject to changes in the market, such as changes in interest rates or rental demand. As a result, it’s important to regularly review and update the assumptions in the financial model to ensure it remains accurate and relevant.

Collaborating with Other Stakeholders

Real estate investments often involve multiple stakeholders, such as lenders, partners, and property managers. Collaborating with these stakeholders can help ensure that the financial model takes into account all relevant factors and is as accurate as possible.

Conclusion

All in all, real estate financial modeling is a valuable tool that can help investors make informed decisions about potential real estate investments. By creating a mathematical model that takes into account key financial factors such as revenue projections, operating expenses, capital expenditures, and financing, investors can assess the potential profitability of an investment and identify potential risks.

When creating a real estate financial model, it’s important to ensure accuracy and perform sensitivity analysis to assess the impact of changes in assumptions on the model’s outputs. Regularly updating the assumptions and collaborating with other stakeholders can also help ensure that the model remains accurate and relevant.

At Realty Capital Analytics, our expertise spans real estate financial modeling, fund modeling, asset management strategies, deal structuring, syndication consulting, and pitch deck preparation. We offer a wide range of financial models tailored to various property types and investment strategies, including:

Multifamily Real Estate Financial Models

Industrial Real Estate Financial Models

Office Real Estate Financial Models

Retail Real Estate Financial Models

Mixed-Use Real Estate Financial Models

Land Development Financial Models

Hotel/Hospitality Real Estate Financial Models

Waterfalls & Partnership Structuring

Townhome Development Financial Models

Condominium Development Financial Models

Self-Storage Real Estate Financial Models

Senior Living Financial Models

Mobile Home & RV Park Financial Models

"Back of the Envelope" Real Estate Financial Models

Single-Family Fix/Flip & Airbnb Financial Models

Our team is dedicated to offering tailored solutions that enhance value and optimize outcomes for our clients. We invite you to leverage our comprehensive services for your real estate investment needs. Contact Realty Capital Analytics for a complimentary consultation, and let's discuss how we can support your objectives with precision and professional insight.