Crystallized Promotes in Real Estate Syndications

A basic promoted interest, or a promote, is a form of incentive compensation typically used in real estate joint ventures and syndications in order to reward a sponsor, or General Partner (GP), for generating profits. The promote is usually structured as an additional share of profits from the venture after all investors have received distributions fully returning their invested capital, together with some stipulated return on that capital (usually the “preferred return” or “pref” as many call it).

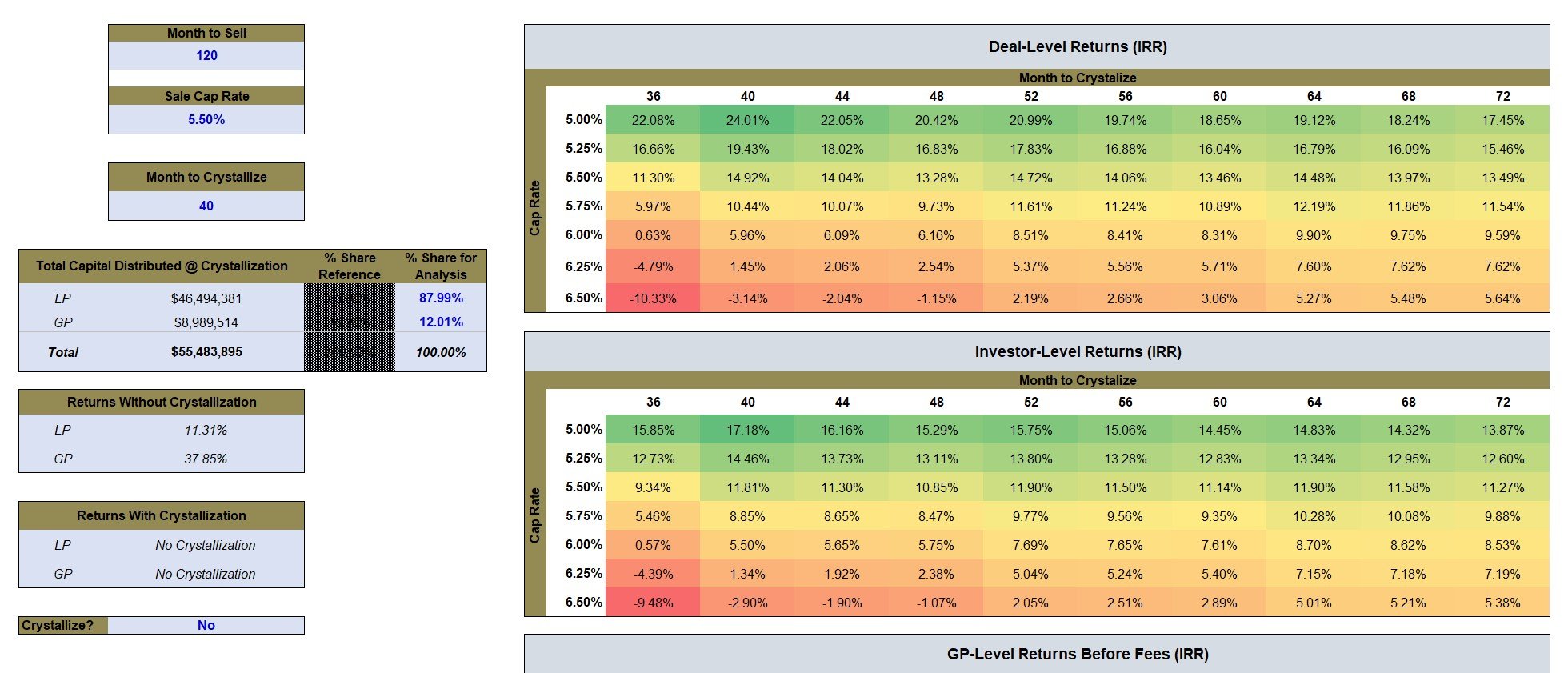

In many cases, a promote is not earned or paid until there is a capital event, such as a sale or refinancing, that generates enough proceeds to provide for the return of capital and the required preferred return or hurdle; however, in certain situations, in particular when the business plan of the venture contemplates a long-term hold, the parties may agree that the promote will be earned and paid where the sponsor has created value in advance of the occurrence of a capital event (sometimes referred to as a “crystallized carry” or “crystallized promote”). This article discusses the use of such a crystallized carry structure.

How Promotes and Distributions are Typically Setup

The traditional commercial real estate joint venture or syndication typically includes one or more investors that fund the majority of the required equity contribution (collectively, the “capital partner” or “limited partners” [LP’s]) and a managing member or sponsor entity that identifies the investment opportunity, devises a strategy for the investment, manages the day-to-day development and/or operation of the property and handles the financing, refinancing and ultimate disposition of the property. The promote is intended to compensate the sponsor for creating value in the investment.

Since an investment’s ultimate value is a function of the amount and timing of the investor’s cash returns, both in the form of rent or other operating income and in the form of sale, refinancing or other capital proceeds, the promote is typically built into the distribution waterfall in the venture’s joint venture agreement. Although distribution waterfalls can vary widely, a relatively simple example is as follows:

First, 100% of distributable cash goes to both the capital partners and the sponsor, in proportion to the amount each has invested in the deal, until each member receives proceeds sufficient to provide each member with an 8% internal rate of return (including a return of capital) – this is typically known as the “pref” or “preferred return”. In this example let’s assume the sponsor contributed 5% of the required equity, and the capital partners contributed 95%;

Second, once members have received their initial invested capital back along with an 8% return, proceeds shall be distributed 20% to the sponsor, and 80% to capital partners until the capital partners have received a 12% return;

And thereafter, proceeds shall be distributed 40% to the sponsor and 60% to the capital partners.

As you can see, the sponsor (or “general partner” [GP]), receives a promoted interest in the deal as the asset’s performance improves along with the return investors are receiving.

Crystallized Carry

In recent years, it has become more common for ventures to pay promotes in the absence of a capital event. Instead of calculating and paying the sponsor’s promote on the basis of actual cash generated, the promote is calculated (and sometimes paid) upon the occurrence of a specified event that corresponds with the creation of value but which does not necessarily generate cash for distribution—for example, completion of development or the lease-up and stabilization of a development project. This “crystallization” of the promote compensates the sponsor for increases in value resulting from the sponsor’s efforts at the time those efforts are expended, even though the ultimate performance of the investment might not have yielded any (or the same amount of) promote due to a drop in value, poor cash flow or additional capital contributions required after crystallization.

This model is especially appropriate where sponsors are partnered with capital partners with a long-term hold strategy and where sponsors do not have the ability in the joint venture documentation to trigger a capital event. Sponsor entities often share the promote with key employees as incentive compensation, and some of the employees who are the ultimate recipients of some or all of the promote may not be expected to remain with the sponsor for the entire life of the investment or may be disinclined to wait until the ultimate disposition of the investment to be compensated for their efforts. The crystallized promote structure allows the sponsor to compensate the employees within a period shorter than the actual holding period of the investment.

Understand the impact of Crystallization on your deal with clarity.

Schedule a free strategy call for details.

Mechanisms for Crystallization

There are various mechanisms for crystallization of promotes. In the case of ground-up development, the sponsor may have a right during a specified period following a milestone event within which to elect to crystallize its promote. For example, the sponsor may have one year from completion of the project or stabilized occupancy to elect to crystallize. Alternatively, the crystallization may be automatic upon the occurrence of the milestone event. In the sponsor’s view, by crystallizing the promote when the sponsor has finished the development or completed leasing activity, the sponsor’s compensation may more accurately reflect the value the sponsor actually brought to the project, without subsequent fluctuations in value that are, at least in part, beyond the sponsor’s control due to market fluctuations and other external factors.

In joint ventures where partnership interests are transferable, the promote may be crystallized, and the amount of the promote determined, based on the price received in connection with such transfers. One possible hybrid approach is to pay a portion of the promote upon completion of construction or stabilization, with the remaining portion payable at some future point if the value of the property increases above the value on which the crystallized promote was based.

Where the promote is paid following a refinancing or sale of the underlying property, the refinancing or sale proceeds determine the amount of distributed cash and therefore the calculation of the promote is relatively simple. However, where the promote is crystallized, there is no extrinsic event to determine the value of the property for purposes of calculating the promote, and the parties will therefore need to agree on an alternative method. This may be based on the amount that would be distributed to the sponsor as promote under the agreed upon distribution waterfall if the underlying asset were sold to a third party as of the specified crystallization date for an all cash price equal to the appraised value of such asset. The joint venture agreement will typically specify an appraisal process for the parties to follow in connection with the crystallization.

For example, the parties may pre-agree on a list of approved appraisers, required appraiser qualifications and specified valuation methodologies. One issue that may arise in negotiating the calculation of the promote is whether to deduct from the hypothetical sale proceeds an amount representing the reserve that an actual seller may set aside for liabilities arising out of the sale; the investors may argue that deducting such a reserve causes the hypothetical sale to more closely resemble an actual sale, while the sponsor would argue that in most sale transactions there is no actual post-closing liability and that reserves established for funding such liabilities are typically released to the seller.

When a promote is crystallized outside of a capital event, there are several ways in which the crystallized promote may be paid to the sponsor. Options may include: (i) each of the capital partners paying the sponsor such partner’s pro rata share of the amount of the crystallized promote out of its own funds, or (ii) having the crystallized promote treated as a capital contribution by the sponsor to the joint venture (which would dilute the equity interest of the capital partners on a pro rata basis) or paying the amount of the promote, possibly with interest, out of distributions that would otherwise be made to the capital partners.

Things to Consider in the Agreement

Joint venture agreements should specify how distributions are made after the promote is crystallized. At that point there is no further promote to be paid to the sponsor (and with respect to multi-asset joint ventures, once promote is crystallized with respect to one asset, no further promote is paid with respect to that asset). In effect the sponsor is now pari passu with the capital partner to the extent the sponsor has contributed capital to the venture, and the sponsor has given up future upside, other than on account of its capital interest, in exchange for crystallizing the promote early.

In multi-asset real estate joint ventures parties typically agree that the sponsor’s promote will be calculated based on the joint venture’s overall performance as opposed to on a property-by-property basis, with the former method preferred by the capital partner in that any loss on one asset will offset gains on other assets and reduce the overall promote. However, the parties will sometimes agree to pay an interim promote in connection with a property-specific capital event.